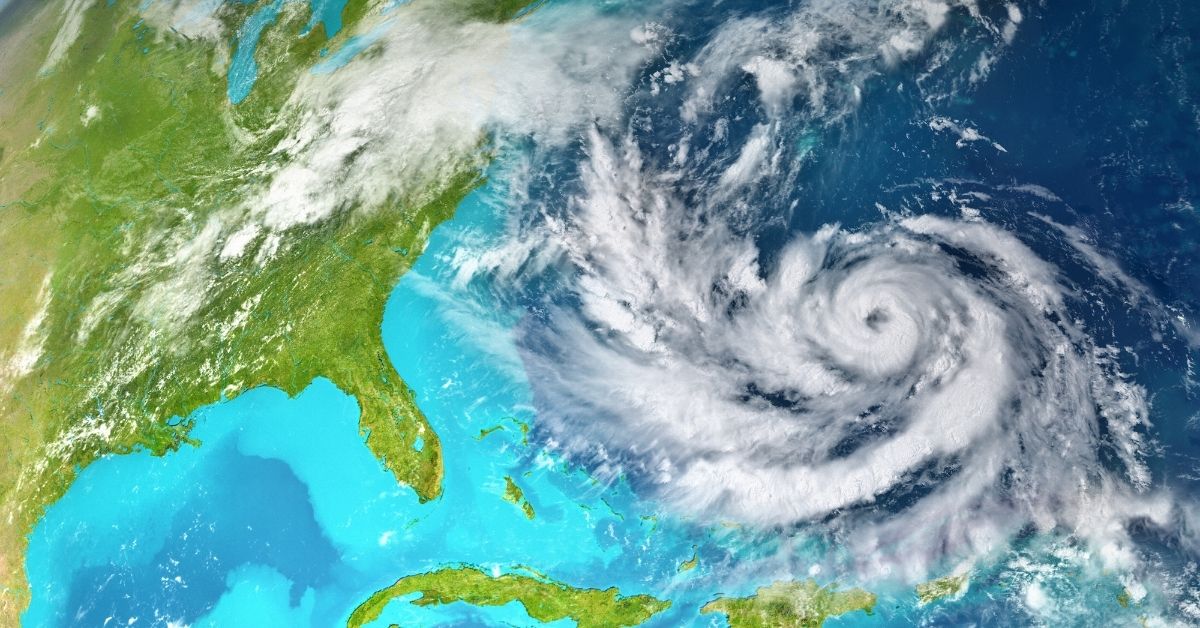

How to Prepare for a Hurricane in Florida

Hurricanes often leave the destruction of property and lives in their wake. Preparing your home, your property, and your family for a hurricane can help minimize the damage and impact of the storm. Here are some essential tips to ensure that you and your family are ready when a hurricane hits. Prepare Your Home Use Learn More “How to Prepare for a Hurricane in Florida”